|

|

Post by glennkoks on Jul 5, 2022 12:52:46 GMT

No two economists agree on whether or not we are even going to have a recession. They keep touting the high employment rate and the resiliency of the consumer etc. I am still trying to come up with the parameters I need to see before moving my portfolio back into the market?

First and foremost the Fed has to get a hold on inflation. Soft landing or hard crash economically we can't prosper with double digit inflation. Stock valuations (AKA The Buffett Indicator) need to be closer to historic norms and not crazy out of whack with overvalued stocks. Republican's taking control of both houses of Congress would be a good thing. Historically the market has done just as well under Democrats as it has under Republicans and I normally try to keep my politics out of my financial planning but this administration has been an absolute train wreck. Long term energy policy would be a plus. Some kind of peaceful resolution to the War in the Ukraine would be a positive. Employment needs to stay strong or at least be on the upswing after the expected downturn.

I think I will just stay on the sidelines until the fundamentals look better or are at least on the uptick and wait for that telltale sign of rising highs and rising lows. Now it seems we have sinking lows and sinking highs.

I have heard from many people who have said things like "you have to be in the market for the long haul", "you can't time the market" etc. To which I say: "Why do we have fundamentals if we are going to ignore them?" and I am not trying to time the market perfectly. I did not get out at the high and I probably won't get back in at the low. So long as I get back in lower than I got out I have protected wealth...

|

|

|

|

Post by Sigurdur on Jul 5, 2022 14:34:01 GMT

|

|

|

|

Post by missouriboy on Jul 5, 2022 16:51:21 GMT

The Gold Bulls are Bullish.

|

|

|

|

Post by code on Jul 5, 2022 18:15:02 GMT

The Gold Bulls are Bullish.

Toilet paper is the new gold |

|

|

|

Post by code on Jul 5, 2022 18:15:08 GMT

The last couple of paragraphs stand out to me.

|

|

|

|

Post by walnut on Jul 5, 2022 22:28:29 GMT

No two economists agree on whether or not we are even going to have a recession. They keep touting the high employment rate and the resiliency of the consumer etc. I am still trying to come up with the parameters I need to see before moving my portfolio back into the market? First and foremost the Fed has to get a hold on inflation. Soft landing or hard crash economically we can't prosper with double digit inflation. Stock valuations (AKA The Buffett Indicator) need to be closer to historic norms and not crazy out of whack with overvalued stocks. Republican's taking control of both houses of Congress would be a good thing. Historically the market has done just as well under Democrats as it has under Republicans and I normally try to keep my politics out of my financial planning but this administration has been an absolute train wreck. Long term energy policy would be a plus. Some kind of peaceful resolution to the War in the Ukraine would be a positive. Employment needs to stay strong or at least be on the upswing after the expected downturn. I think I will just stay on the sidelines until the fundamentals look better or are at least on the uptick and wait for that telltale sign of rising highs and rising lows. Now it seems we have sinking lows and sinking highs.

I have heard from many people who have said things like "you have to be in the market for the long haul", "you can't time the market" etc. To which I say: "Why do we have fundamentals if we are going to ignore them?" and I am not trying to time the market perfectly. I did not get out at the high and I probably won't get back in at the low. So long as I get back in lower than I got out I have protected wealth... You are not really on the sidelines at all. You are likely holding a bunch of Biden Dollars, which are relatively very high lately as stocks sold off and were traded for dollars. I think it's time to buy solid stocks again. This recession will be a dud. You'll be better served if you begin to measure your wealth in US equities, not monopoly currency. After a few years you will be happy that you got out of that old habit.

Think like Warren and Charlie...

(I'm not meaning to single you out Glenn, I'm kinda speaking generally)

|

|

|

|

Post by ratty on Jul 6, 2022 0:59:43 GMT

[ Snip ] This recession will be a dud. [ Snip ] Walnut, I have no reason to doubt you but I will make an entry in my calendar for this time next year.    |

|

|

|

Post by walnut on Jul 6, 2022 1:12:36 GMT

[ Snip ] This recession will be a dud. [ Snip ] Walnut, I have no reason to doubt you but I will make an entry in my calendar for this time next year.    That's fair enough.

Even if there is a recession, much of the trouble is already forecasted into these already low stock prices. Wouldn't you prefer to own good businesses rather than Monopoly money?

Our business is definitely down, but I think that they are talking about something that has largely already happened. We noticed the slowdown months ago. The recession just does not seem to have legs. I could be wrong, maybe it just gets worse and worse, but I'm not sensing that myself yet.

|

|

|

|

Post by walnut on Jul 6, 2022 1:32:29 GMT

Maybe I spoke too soon? Did the EV industry just fail?? Isn't this the definition of "bankruptcy"? holy shit

That's not cool, Elon. Pay your bills.

www.tiktok.com/t/ZTRNeoCyV/?k=1 |

|

|

|

Post by walnut on Jul 6, 2022 10:52:46 GMT

Maybe I spoke too soon? Did the EV industry just fail?? Isn't this the definition of "bankruptcy"? holy shit

That's not cool, Elon. Pay your bills.

www.tiktok.com/t/ZTRNeoCyV/?k=1. Looks like this was old, bad news. |

|

|

|

Post by glennkoks on Jul 6, 2022 20:36:13 GMT

No two economists agree on whether or not we are even going to have a recession. They keep touting the high employment rate and the resiliency of the consumer etc. I am still trying to come up with the parameters I need to see before moving my portfolio back into the market? First and foremost the Fed has to get a hold on inflation. Soft landing or hard crash economically we can't prosper with double digit inflation. Stock valuations (AKA The Buffett Indicator) need to be closer to historic norms and not crazy out of whack with overvalued stocks. Republican's taking control of both houses of Congress would be a good thing. Historically the market has done just as well under Democrats as it has under Republicans and I normally try to keep my politics out of my financial planning but this administration has been an absolute train wreck. Long term energy policy would be a plus. Some kind of peaceful resolution to the War in the Ukraine would be a positive. Employment needs to stay strong or at least be on the upswing after the expected downturn. I think I will just stay on the sidelines until the fundamentals look better or are at least on the uptick and wait for that telltale sign of rising highs and rising lows. Now it seems we have sinking lows and sinking highs.

I have heard from many people who have said things like "you have to be in the market for the long haul", "you can't time the market" etc. To which I say: "Why do we have fundamentals if we are going to ignore them?" and I am not trying to time the market perfectly. I did not get out at the high and I probably won't get back in at the low. So long as I get back in lower than I got out I have protected wealth... You are not really on the sidelines at all. You are likely holding a bunch of Biden Dollars, which are relatively very high lately as stocks sold off and were traded for dollars. I think it's time to buy solid stocks again. This recession will be a dud. You'll be better served if you begin to measure your wealth in US equities, not monopoly currency. After a few years you will be happy that you got out of that old habit.

Think like Warren and Charlie...

(I'm not meaning to single you out Glenn, I'm kinda speaking generally)

Technically the recession has not even begun yet. Neither has the Bear Market at least as far as the S&P 500 is concerned. I think I will wait a while longer to cash in my Biden Dollars and trade them back in for stocks. |

|

|

|

Post by walnut on Jul 6, 2022 20:57:28 GMT

You are not really on the sidelines at all. You are likely holding a bunch of Biden Dollars, which are relatively very high lately as stocks sold off and were traded for dollars. I think it's time to buy solid stocks again. This recession will be a dud. You'll be better served if you begin to measure your wealth in US equities, not monopoly currency. After a few years you will be happy that you got out of that old habit.

Think like Warren and Charlie...

(I'm not meaning to single you out Glenn, I'm kinda speaking generally)

Technically the recession has not even begun yet. Neither has the Bear Market at least as far as the S&P 500 is concerned. I think I will wait a while longer to cash in my Biden Dollars and trade them back in for stocks. I hear ya but their definition of a recession is two consecutive quarters of declining GDP. By the time they report it, it's already old news. The data will show a recession has been occurring since the start of the year. It's already baked into the stock market, especially the Nasdaq.

Maybe you will be correct, this could be long and drawn out. But I'm fine owning good quality stocks.

|

|

|

|

Post by missouriboy on Jul 6, 2022 21:23:52 GMT

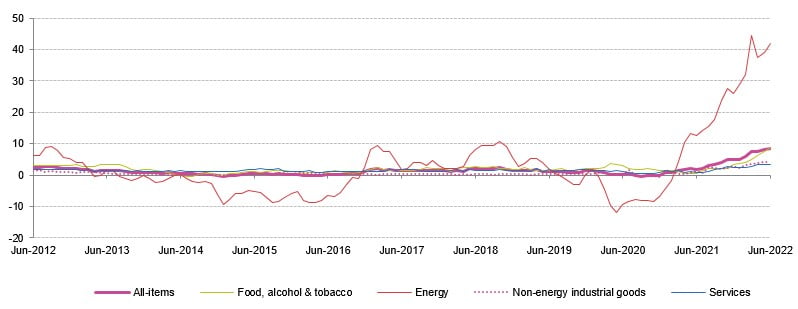

Inflation in the Eurozone

|

|

|

|

Post by glennkoks on Jul 6, 2022 22:04:14 GMT

Technically the recession has not even begun yet. Neither has the Bear Market at least as far as the S&P 500 is concerned. I think I will wait a while longer to cash in my Biden Dollars and trade them back in for stocks. I hear ya but their definition of a recession is two consecutive quarters of declining GDP. By the time they report it, it's already old news. The data will show a recession has been occurring since the start of the year. It's already baked into the stock market, especially the Nasdaq.

Maybe you will be correct, this could be long and drawn out. But I'm fine owning good quality stocks.

Walnut, you are in a good spot because I have seldom been correct! |

|

|

|

Post by walnut on Jul 6, 2022 22:37:36 GMT

I hear ya but their definition of a recession is two consecutive quarters of declining GDP. By the time they report it, it's already old news. The data will show a recession has been occurring since the start of the year. It's already baked into the stock market, especially the Nasdaq.

Maybe you will be correct, this could be long and drawn out. But I'm fine owning good quality stocks.

Walnut, you are in a good spot because I have seldom been correct! Probably we're both going to be just fine lol. Everybody wins |

|