|

|

Post by duwayne on Jun 24, 2022 18:14:31 GMT

Glennkoks, In your post above with respect to QE, you say "We are in uncharted waters when it comes to the long term effects of QE. The only example we have is Japan and the results have been well documented in their lost decades."

I spent a few minutes checking up on QE in Japan and it appears that QE use began in Japan in 2001. Since that time the Japanese stock market has gone up about 300% reversing a long period of decline. (I noted what I believe were the reasons for the decline in an earlier post.)

The US began using QE in 2008, 7 years after the initial use in Japan, apparently in part, due to the success in Japan. Let me ask this specific question. Why do you see Japan as an indicator of QE being dangerous?

And to repeat, I'm not trying to convince you to invest in stocks.

|

|

|

|

Post by glennkoks on Jun 25, 2022 18:34:45 GMT

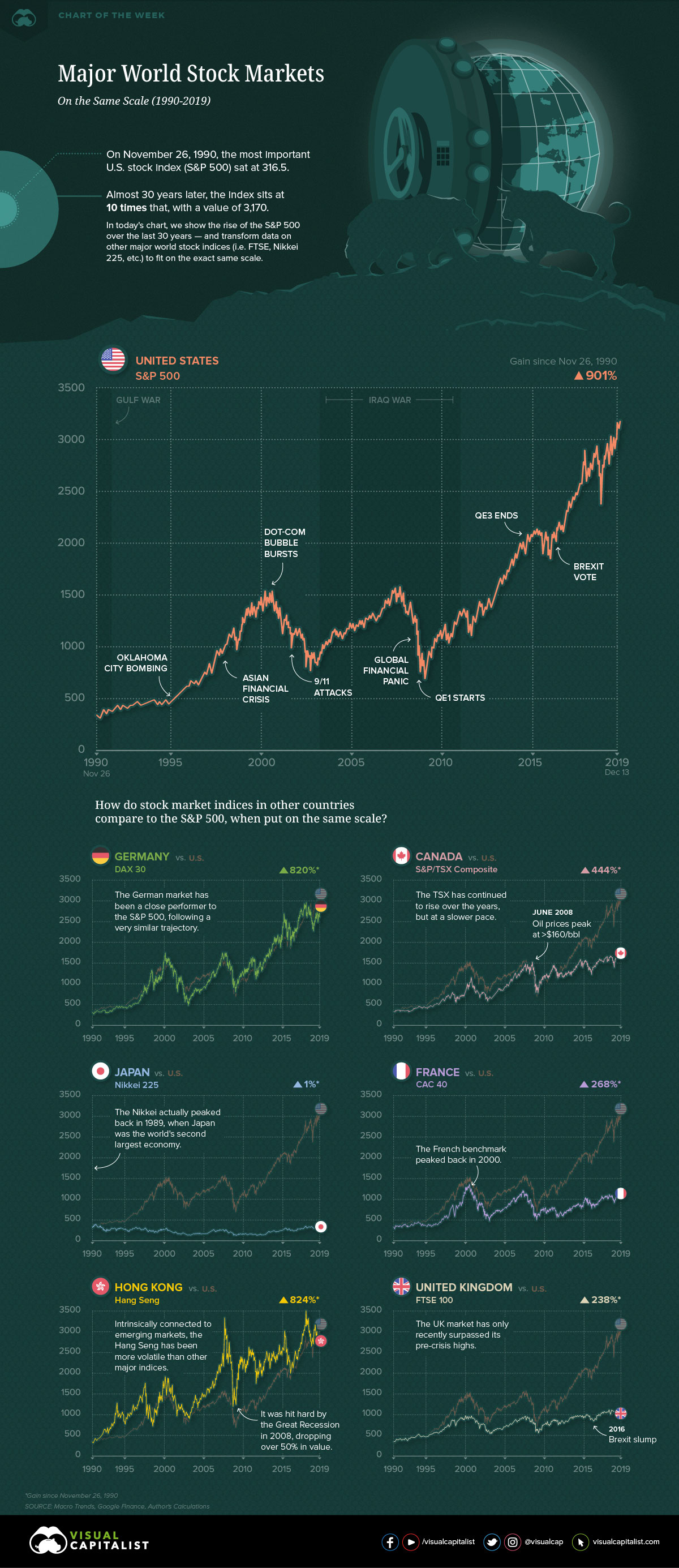

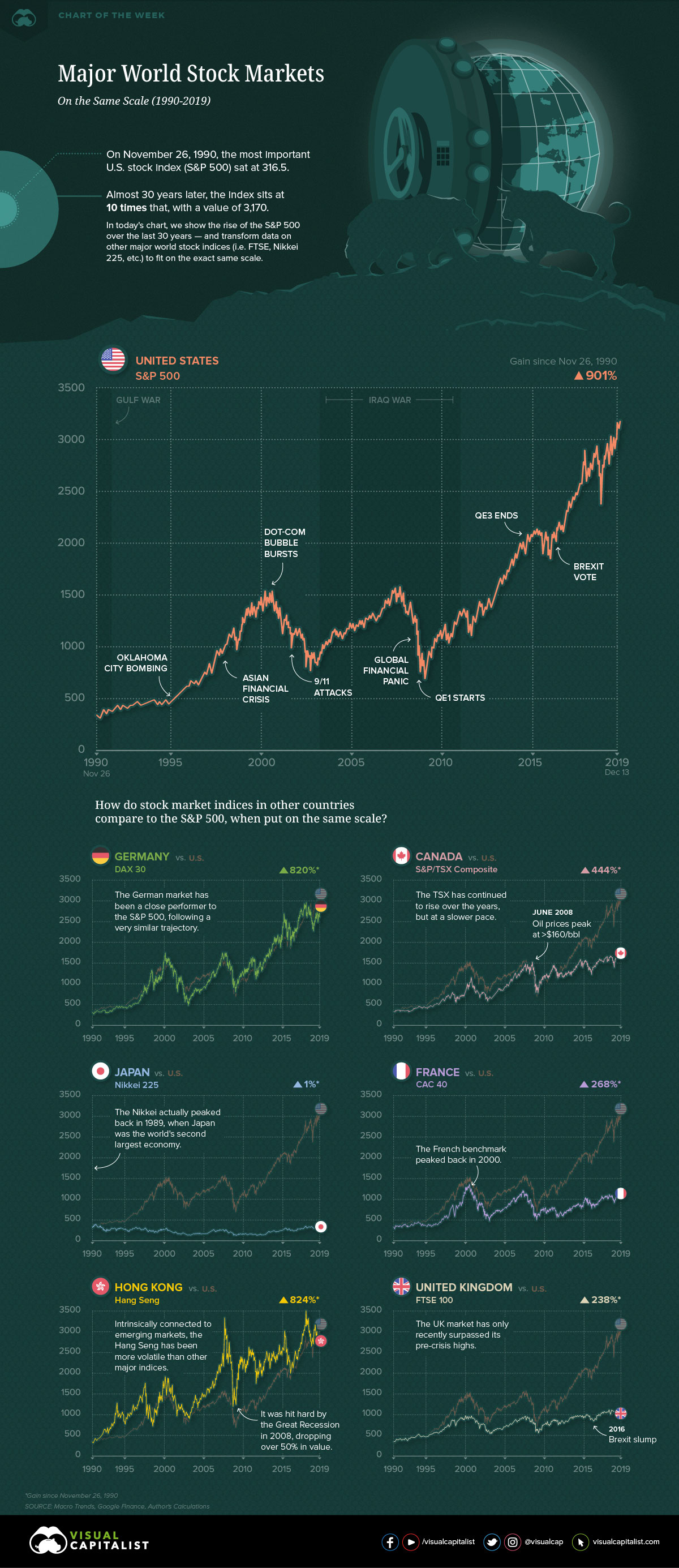

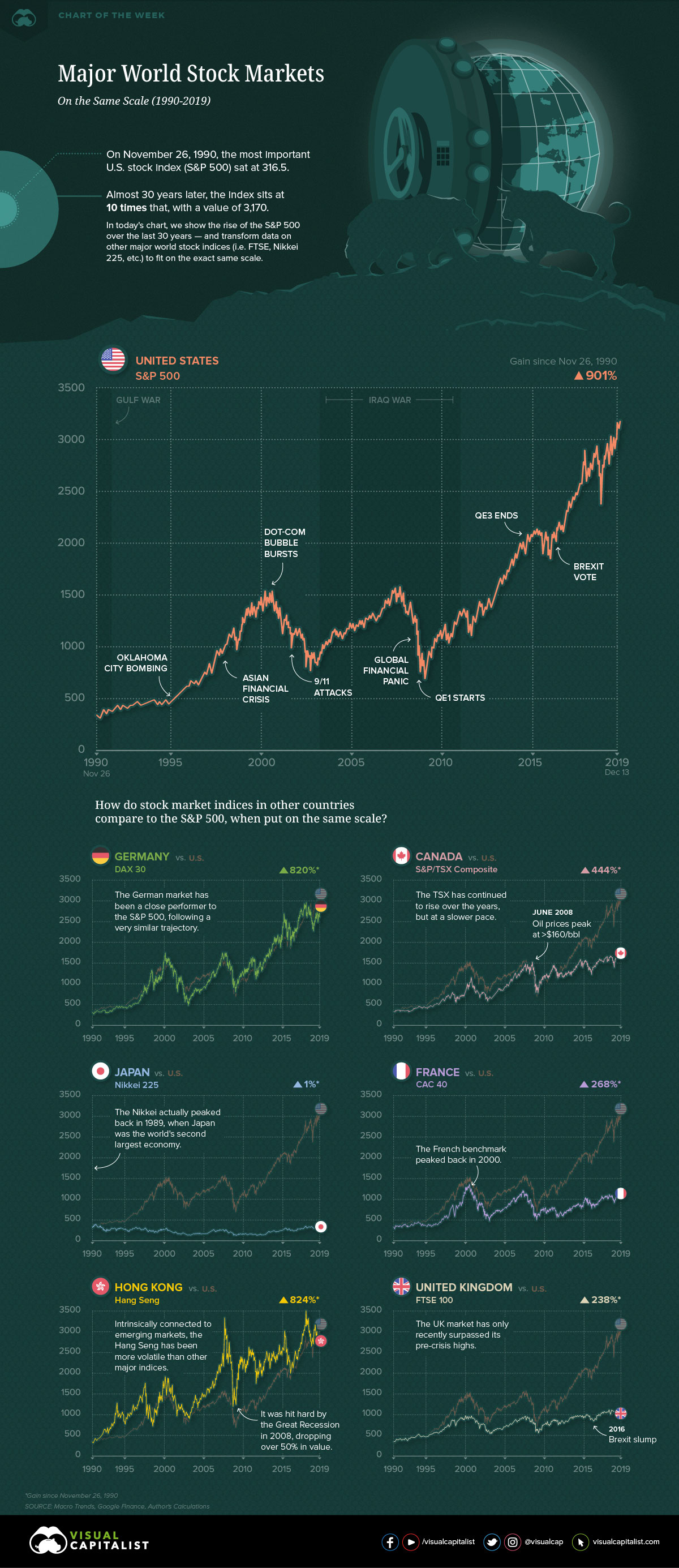

duwayne, The Japanese stock market peaked in October of 1989 just shy of 39,000. It is currently at 26,491. It's had over 30 years of negative returns. From 1990 to 2019 the: S&P 500 is up 901% Germany's DAX 30 is up 820% Canada's 444% France 268% Hong Kong 824% UK 238% Japan's is a miserable 1% Nobody has done QE longer than Japan. The results are clear. Simply look at all the above markets from 2001 until they started QE. Japan's stock market is many, many times worse off than those who did not QE over the same period. |

|

|

|

Post by duwayne on Jun 25, 2022 23:02:04 GMT

duwayne, The Japanese stock market peaked in October of 1989 just shy of 39,000. It is currently at 26,491. It's had over 30 years of negative returns. From 1990 to 2019 the: S&P 500 is up 901% Germany's DAX 30 is up 820% Canada's 444% France 268% Hong Kong 824% UK 238% Japan's is a miserable 1% Nobody has done QE longer than Japan. The results are clear. Simply look at all the above markets from 2001 until they started QE. Japan's stock market is many, many times worse off than those who did not QE over the same period. Glennkoks, there’s nothing in what you’ve provided which would give me concern about QE per se. Any tool is subject to misuse and the FED has been able to “print money” for a long time. It is possible that excess QE could kick inflation up a bit. So far, I would see QE as a positive.

Since Japan began using QE their stock market has climbed by more than 250%. The 1% number you show includes the pre-QE period when growth was negative.

The US stock market chart you included above shows when QE began in the US and the overall market growth as shown has been very good since then.

I’m ready to move on to other subjects. |

|

|

|

Post by glennkoks on Jun 26, 2022 0:51:30 GMT

duwayne, There is nothing about that graph of the Japanese stock market that would leave me to believe QE did nothing but fail. Time will tell, and I agree we can move on to other subjects.

|

|

|

|

Post by flearider on Jun 26, 2022 4:36:54 GMT

duwayne, The Japanese stock market peaked in October of 1989 just shy of 39,000. It is currently at 26,491. It's had over 30 years of negative returns. From 1990 to 2019 the: S&P 500 is up 901% Germany's DAX 30 is up 820% Canada's 444% France 268% Hong Kong 824% UK 238% Japan's is a miserable 1% Nobody has done QE longer than Japan. The results are clear. Simply look at all the above markets from 2001 until they started QE. Japan's stock market is many, many times worse off than those who did not QE over the same period. ouch ..glad i'm in the uk .. when those others fall it's a long way down ..  |

|

|

|

Post by missouriboy on Jun 26, 2022 15:01:25 GMT

This article does not even begin to scratch the surface of this issue. And it probably deserves a topic all to its "broader" self. Something like, When Regional and World Economic Systems Implode. History is full of such events, where, when populations outgrow their sustainability (for numerous reasons) huge migrations have ensued. Some are attempts to mix with a successful economy nearby. Some set out to conquer them. How do successful regions retain their success and independence in the face of what appears to be a rapidly destabilizing World? Implosions within otherwise wealthy societies also occur ... and might be titled ... the Unproductive Left will exterminate you, and itself, if left unchecked.

|

|

|

|

Post by Sigurdur on Jun 26, 2022 16:57:18 GMT

|

|

|

|

Post by glennkoks on Jun 27, 2022 21:59:40 GMT

Does this qualify as Hyperinflation? A 10' joint of 2 1/2" grey PVC schedule 40 electrical conduit was 13.34 on December 26th 2000 at Home Depot. On February 22nd of this year it was up to 58.94. Today it was 67.63. Thats a 5X increase in 18 months! |

|

|

|

Post by missouriboy on Jun 27, 2022 22:41:12 GMT

Not including gas to pick it up.

|

|

|

|

Post by glennkoks on Jun 27, 2022 23:26:32 GMT

Not including gas to pick it up. At those prices I could not afford to pay for gas in the truck so I walked! |

|

|

|

Post by ratty on Jun 28, 2022 1:26:28 GMT

Not including gas to pick it up. At those prices I could not afford to pay for gas in the truck so I walked! Is the conduit made locally? |

|

|

|

Post by glennkoks on Jun 28, 2022 1:49:38 GMT

At those prices I could not afford to pay for gas in the truck so I walked! Is the conduit made locally? No, and in all fairness I think Hurricane Ida last year in Louisiana jacked up one of the biggest plants or so the excuse goes... |

|

|

|

Post by glennkoks on Jun 28, 2022 1:52:29 GMT

|

|

|

|

Post by Sigurdur on Jun 30, 2022 1:39:46 GMT

|

|

|

|

Post by walnut on Jun 30, 2022 2:59:49 GMT

This is some good wisdom by Charlie Munger.

|

|