|

|

Post by Sigurdur on Apr 3, 2023 18:48:35 GMT

Oil-production cuts could force Fed to raise interest rates even higher to fight inflation

2:10 pm ET April 3, 2023 (MarketWatch)

Print

By Joseph Adinolfi

Here's what it means for stocks, bonds and other assets

A surprise production cut by Saudi Arabia and several of its OPEC+ partners could complicate the outlook for stocks, bonds and currencies while undercutting the fight against inflation by the Federal Reserve and other central banks, analysts said.

Of course, some analysts expect it could ultimately have the opposite effect by helping to quicken the global economy's slide into recession. In this scenario, the economic blowback from any oil-price shock would be similar to the credit crunch resulting from the collapse of Silicon Valley Bank that Federal Reserve President Jerome Powell highlighted during a press conference last month.

To recap: on Sunday, Saudi Arabia's Ministry of Energy and a handful of OPEC+ members announced they would cut production by a combined 1.16 million barrels a day starting in May and lasting through the end of the year.

The Kingdom led the way with a planned cut of 500,000 barrels per day, with Iraq, Oman, Kazakhstan, the United Arab Emirates, Kuwait and Algeria making up the rest. On top of this, Russia said it would extend its own voluntary production cut of half-a-million barrels per day through the end of the year. It had been due to expire at the end of June.

At first brush, the cut appears timed to coincide with the pre-summer increase in oil refinery production as producers and refiners prepare for the busy summer travel season in North America, said Jorge Leon, senior vice president of oil markets research at Rystad Energy, in a note to clients.

The cartel has been using production cuts in an effort to bolster prices for months now, much to the consternation of the Biden administration. This latest move comes on top of a 2 million-barrels-per-day cut announced back in October, the largest cut by the cartel since the advent of the COVID-19 pandemic back in 2020.

However, the October move offered little lasting support for oil prices, with crude drifting lower into year-end and then extending its decline in the first quarter of 2023.

Oil traders caught off guard

|

|

|

|

Post by gridley on Apr 4, 2023 11:34:41 GMT

Gee its a good thing we've got a Strategic Petroleum Reserve... oh wait...

|

|

|

|

Post by blustnmtn on Apr 4, 2023 13:01:56 GMT

Oil-production cuts could force Fed to raise interest rates even higher to fight inflation 2:10 pm ET April 3, 2023 (MarketWatch) Print By Joseph Adinolfi Here's what it means for stocks, bonds and other assets A surprise production cut by Saudi Arabia and several of its OPEC+ partners could complicate the outlook for stocks, bonds and currencies while undercutting the fight against inflation by the Federal Reserve and other central banks, analysts said. Of course, some analysts expect it could ultimately have the opposite effect by helping to quicken the global economy's slide into recession. In this scenario, the economic blowback from any oil-price shock would be similar to the credit crunch resulting from the collapse of Silicon Valley Bank that Federal Reserve President Jerome Powell highlighted during a press conference last month. To recap: on Sunday, Saudi Arabia's Ministry of Energy and a handful of OPEC+ members announced they would cut production by a combined 1.16 million barrels a day starting in May and lasting through the end of the year. The Kingdom led the way with a planned cut of 500,000 barrels per day, with Iraq, Oman, Kazakhstan, the United Arab Emirates, Kuwait and Algeria making up the rest. On top of this, Russia said it would extend its own voluntary production cut of half-a-million barrels per day through the end of the year. It had been due to expire at the end of June. At first brush, the cut appears timed to coincide with the pre-summer increase in oil refinery production as producers and refiners prepare for the busy summer travel season in North America, said Jorge Leon, senior vice president of oil markets research at Rystad Energy, in a note to clients. The cartel has been using production cuts in an effort to bolster prices for months now, much to the consternation of the Biden administration. This latest move comes on top of a 2 million-barrels-per-day cut announced back in October, the largest cut by the cartel since the advent of the COVID-19 pandemic back in 2020. However, the October move offered little lasting support for oil prices, with crude drifting lower into year-end and then extending its decline in the first quarter of 2023. Oil traders caught off guard Too bad we don't have any areas in our vast country where we could get our own oil...wait...  |

|

|

|

Post by flearider on Apr 4, 2023 15:58:20 GMT

Oil-production cuts could force Fed to raise interest rates even higher to fight inflation 2:10 pm ET April 3, 2023 (MarketWatch) Print By Joseph Adinolfi Here's what it means for stocks, bonds and other assets A surprise production cut by Saudi Arabia and several of its OPEC+ partners could complicate the outlook for stocks, bonds and currencies while undercutting the fight against inflation by the Federal Reserve and other central banks, analysts said. Of course, some analysts expect it could ultimately have the opposite effect by helping to quicken the global economy's slide into recession. In this scenario, the economic blowback from any oil-price shock would be similar to the credit crunch resulting from the collapse of Silicon Valley Bank that Federal Reserve President Jerome Powell highlighted during a press conference last month. To recap: on Sunday, Saudi Arabia's Ministry of Energy and a handful of OPEC+ members announced they would cut production by a combined 1.16 million barrels a day starting in May and lasting through the end of the year. The Kingdom led the way with a planned cut of 500,000 barrels per day, with Iraq, Oman, Kazakhstan, the United Arab Emirates, Kuwait and Algeria making up the rest. On top of this, Russia said it would extend its own voluntary production cut of half-a-million barrels per day through the end of the year. It had been due to expire at the end of June. At first brush, the cut appears timed to coincide with the pre-summer increase in oil refinery production as producers and refiners prepare for the busy summer travel season in North America, said Jorge Leon, senior vice president of oil markets research at Rystad Energy, in a note to clients. The cartel has been using production cuts in an effort to bolster prices for months now, much to the consternation of the Biden administration. This latest move comes on top of a 2 million-barrels-per-day cut announced back in October, the largest cut by the cartel since the advent of the COVID-19 pandemic back in 2020. However, the October move offered little lasting support for oil prices, with crude drifting lower into year-end and then extending its decline in the first quarter of 2023. Oil traders caught off guard Too bad we don't have any areas in our vast country where we could get our own oil...wait...  thats what i thought just increase production and fill the market ? win win ? unless there's a plan ahead |

|

|

|

Post by code on Apr 5, 2023 4:08:00 GMT

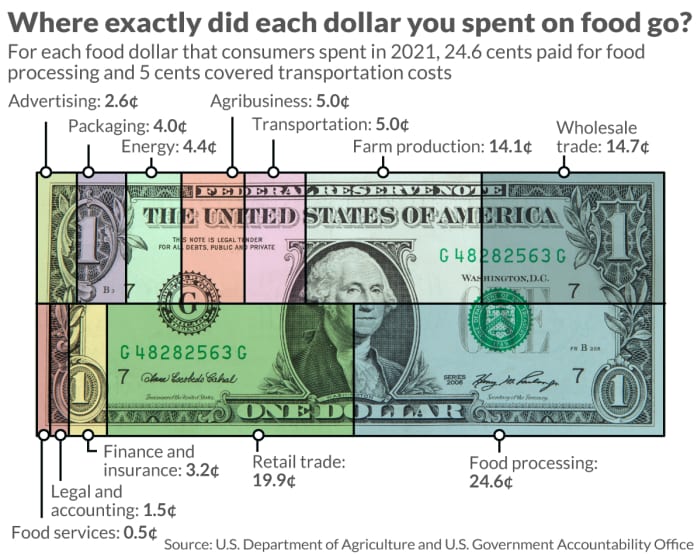

Where exactly each dollar you spend on food goes: farmers get 14 cents and 4 cents pays for packaging A new report examines what each food dollar pays for, from food processing to packaging

|

|

|

|

Post by missouriboy on Apr 6, 2023 0:40:52 GMT

If you want to break the Federal bureaucracy, this might do it. Which is exactly why the bill won't pass.

This may not come to pass ... but interesting as gold hits a new high.

|

|

|

|

Post by walnut on Apr 6, 2023 0:58:57 GMT

If you want to break the Federal bureaucracy, this might do it. Which is exactly why the bill won't pass.

This may not come to pass ... but interesting as gold hits a new high.

There really is no answer, IMO. A gold standard would drive gold to $20k an ounce real fast. The world economy is much much larger than it was 50 years ago. Very deflationary.

What we need is a responsible, transparent, honest, and wise Central Bank. Good luck with that, right. Sort of like, we need a wise, beneficent King to rule over us.

|

|

|

|

Post by missouriboy on Apr 6, 2023 3:40:36 GMT

If you want to break the Federal bureaucracy, this might do it. Which is exactly why the bill won't pass.

This may not come to pass ... but interesting as gold hits a new high.

There really is no answer, IMO. A gold standard would drive gold to $20k an ounce real fast. The world economy is much much larger than it was 50 years ago. Very deflationary.

What we need is a responsible, transparent, honest, and wise Central Bank. Good luck with that, right. Sort of like, we need a wise, beneficent King to rule over us.

I'll take the $20K per oz.  And $250 per oz silver. What's not to like? |

|

|

|

Post by walnut on Apr 6, 2023 3:57:42 GMT

There really is no answer, IMO. A gold standard would drive gold to $20k an ounce real fast. The world economy is much much larger than it was 50 years ago. Very deflationary.

What we need is a responsible, transparent, honest, and wise Central Bank. Good luck with that, right. Sort of like, we need a wise, beneficent King to rule over us.

I'll take the $20K per oz.  And $250 per oz silver. What's not to like? Yes, it might be interesting to re-visit the middle ages. Apparently my ancestors survived it.  |

|

|

|

Post by nonentropic on Apr 6, 2023 4:07:28 GMT

There is a problem here in as much that gold is largely infinite subject to price.

NZ is by no means a gold rich place but the quantity of gold in rivers at o.5gm/Tonne is stupendous and at $5000/oz that will come flooding into the market Australia is an order of magnitude or 2 larger than us so inflation which was the problem when the Europeans found South America and the gold they took home will only get bigger. Be careful what you wish for.

|

|

|

|

Post by missouriboy on Apr 6, 2023 6:58:15 GMT

There is a problem here in as much that gold is largely infinite subject to price. NZ is by no means a gold rich place but the quantity of gold in rivers at o.5gm/Tonne is stupendous and at $5000/oz that will come flooding into the market Australia is an order of magnitude or 2 larger than us so inflation which was the problem when the Europeans found South America and the gold they took home will only get bigger. Be careful what you wish for. That is true. However, I don't see how they could do a worse job than our political hacks. At least they have to go and physically dig it up. A bit harder than instructing Cindy to digitally conjure it from nothing. But they are creative little rascals. I'm sure they'll think of something. It would be real embarrassing if Fort Knox is actually empty. |

|

|

|

Post by nonentropic on Apr 6, 2023 9:29:54 GMT

Ok I see this as a basket approach. Gold being probably one of the hardest to value on utility. It makes up for that on durability understanding and compactness.

When you look at it the price of commodities indicates real "inflation" that is all commodities and weighted by utility or use.

If you think of a Lamb in NZ in 1980 it was $10 and now $160 I eat lamb and it accounts for maybe 2% of my basket. etc.

Gold comes into play if you need to hid or move places, are we thinking that may happen because I will resist movement that I don't do by choice.

|

|

|

|

Post by glennkoks on Apr 6, 2023 12:51:57 GMT

The days of currency backed by gold are over. Governments and politicians need the ability to produce cash on a whim by turning on the presses. I never bought into bitcoin or other crypto currencies but if you think about it logically they are just as real as the American Greenback, Yuan or Euro. Backed by nothing but faith...

|

|

|

|

Post by walnut on Apr 6, 2023 12:55:35 GMT

I have mixed feelings on the matter. I don't think that a return to gold would work, but I could be wrong.

|

|

|

|

Post by walnut on Apr 6, 2023 12:59:28 GMT

There is a problem here in as much that gold is largely infinite subject to price. NZ is by no means a gold rich place but the quantity of gold in rivers at o.5gm/Tonne is stupendous and at $5000/oz that will come flooding into the market Australia is an order of magnitude or 2 larger than us so inflation which was the problem when the Europeans found South America and the gold they took home will only get bigger. Be careful what you wish for. I'm not sure about this, those igneous gold bearing rocks vary from hard to extremely hard. I suppose the price would just continue to go up accordingly. non-linear, self-governing. |

|

And $250 per oz silver. What's not to like?

And $250 per oz silver. What's not to like?