|

|

Post by Sigurdur on Nov 7, 2022 1:00:21 GMT

Goodbye Motherland? Soon it may be European refugees.

The swell of industry leaving Europe for the US has been accelerating. With current administration policies, it may well stop and head to Africa. There are some major oil/gas fields that have been found and are now beginning to be harvested, mostly by EXXON. (Disclaimer, I have some stock in this company). A urea fertilizer plant has been built not far from the find. It is the largest in the world. The US has potentially the largest natural gas reserves in the world. We have fools that don't understand energy and the important part it plays in food production. One has to wonder, is it something in the water in cities that requires idiots to emerge?   |

|

|

|

Post by missouriboy on Nov 7, 2022 1:23:27 GMT

What part of Africa? Will they need an army to guard the perimeter?

|

|

|

|

Post by Sigurdur on Nov 7, 2022 1:41:56 GMT

|

|

|

|

Post by missouriboy on Nov 7, 2022 1:50:42 GMT

So yes. And lots of cash to bribe everyone. My brother worked for Kodak and did the Nigeria runs. Said it was the most corrupt place he ever worked. |

|

|

|

Post by walnut on Nov 7, 2022 2:28:45 GMT

Excellent movie about mining in Africa. Watch it

|

|

|

|

Post by code on Nov 7, 2022 16:09:09 GMT

Enjoying time again in the small mining town of Esterhazy, Saskatchewan, Canada. I've had the pleasure to speak with a wide variety of people during breakfast, who are staying at the hotel and have some connection to the mine. I was fascinated to learn the other day from an engineer the L1 shaft, since now closed, had to be evacuated when there was catastrophic flooded deep in the mine, I was told they quickly had to evacuate everyone and plug the shaft to stop the water from rising up the shaft. Today I was schooled in pumping, and material science.

|

|

|

|

Post by code on Nov 8, 2022 1:27:50 GMT

|

|

|

|

Post by missouriboy on Nov 11, 2022 2:15:21 GMT

Redfin gets flipped. Bye-bye real estate ... for now.

|

|

|

|

Post by missouriboy on Nov 18, 2022 22:47:42 GMT

Congratulations Glenn? Sam would have been proud.

|

|

|

|

Post by missouriboy on Nov 22, 2022 15:56:53 GMT

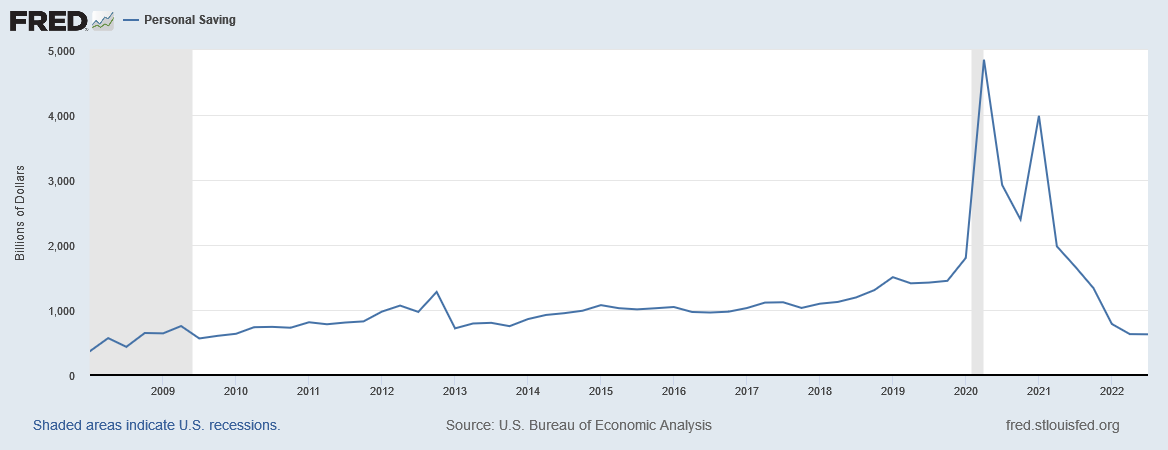

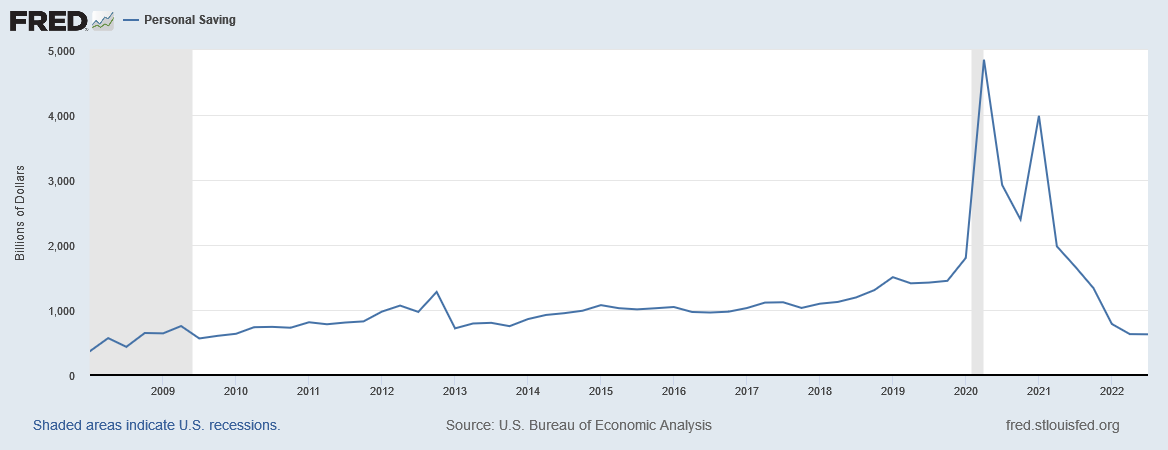

If US household personal savings have anything to do with the US economy and the stock market (cough-cough) then watch out. The bubble is gone. It more than doubled in 2020 from an already high level... and now, 2 years later, only 13% remains. Down to about 2009 levels. With high interest rates here ... what might happen? The thrill is gone. Busting the Federal budget for years to come for essentially a 1-year joy ride.

|

|

|

|

Post by blustnmtn on Nov 22, 2022 16:30:04 GMT

If US household personal savings have anything to do with the US economy and the stock market (cough-cough) then watch out. The bubble is gone. It more than doubled in 2020 from an already high level... and now, 2 years later, only 13% remains. Down to about 2009 levels. With high interest rates here ... what might happen? The thrill is gone. Busting the Federal budget for years to come for essentially a 1-year joy ride.

Anytime an X-Y Plot produces an upturned spike, prepare for trouble. |

|

|

|

Post by missouriboy on Nov 22, 2022 17:23:58 GMT

If US household personal savings have anything to do with the US economy and the stock market (cough-cough) then watch out. The bubble is gone. It more than doubled in 2020 from an already high level... and now, 2 years later, only 13% remains. Down to about 2009 levels. With high interest rates here ... what might happen? The thrill is gone. Busting the Federal budget for years to come for essentially a 1-year joy ride.

Anytime an X-Y Plot produces an upturned spike, prepare for trouble. And that trouble often expresses itself as a sharp downward spike. Extreme variance stresses any system. |

|

|

|

Post by code on Nov 24, 2022 16:43:02 GMT

HelloFresh Under Fire: Suppliers Caught Forcing Chained Monkeys to Pick Coconuts

Is this better or worst treatment than the Foxconn employees in China receive? Next thing we know, these monkeys might be working for Apple.

|

|

|

|

Post by code on Nov 24, 2022 16:49:43 GMT

Sig,

I went back over to Solar Cycle 24, where I exist as deleted, and looked at what we were talking about for the national debt back then, my how it's grown. Now over 31 trillion and projections suggest in about 3 years will be over 41 trillion. I'm thinking to screw buying gold, I'm investing in toilet paper because I recall what my local Costco looked like 2 years ago.

|

|

|

|

Post by Sigurdur on Nov 24, 2022 16:59:12 GMT

Sig, I went back over to Solar Cycle 24, where I exist as deleted, and looked at what we were talking about for the national debt back then, my how it's grown. Now over 31 trillion and projections suggest in about 3 years will be over 41 trillion. I'm thinking to screw buying gold, I'm investing in toilet paper because I recall what my local Costco looked like 2 years ago. The rate of rise of the National Debt isn't slowing enough to prevent economic mayhem. I know the solution, I have not observed any politician with the political will to address this extremely serious problem. |

|